Financial Information

Latest Results Announcement

Condensed Interim Financial Statements For the six months ended 30 June 2025

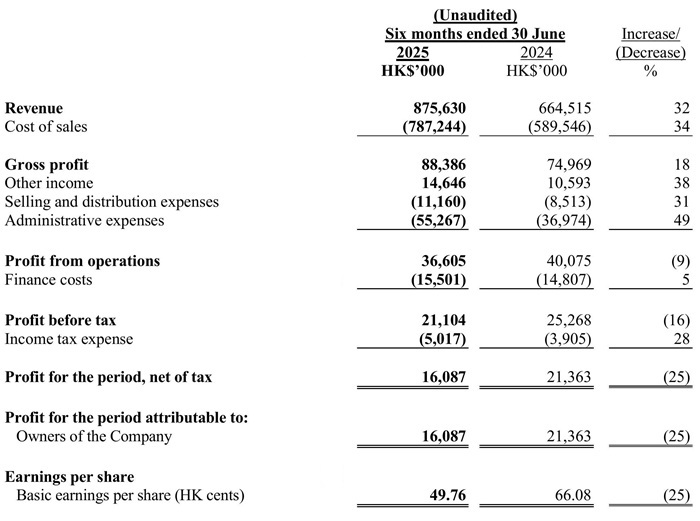

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS FOR THE SIX MONTHS ENDED 30 JUNE 2025

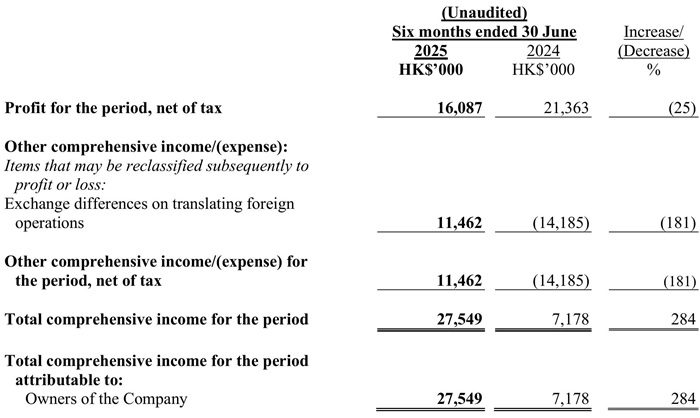

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE SIX MONTHS ENDED 30 JUNE 2025

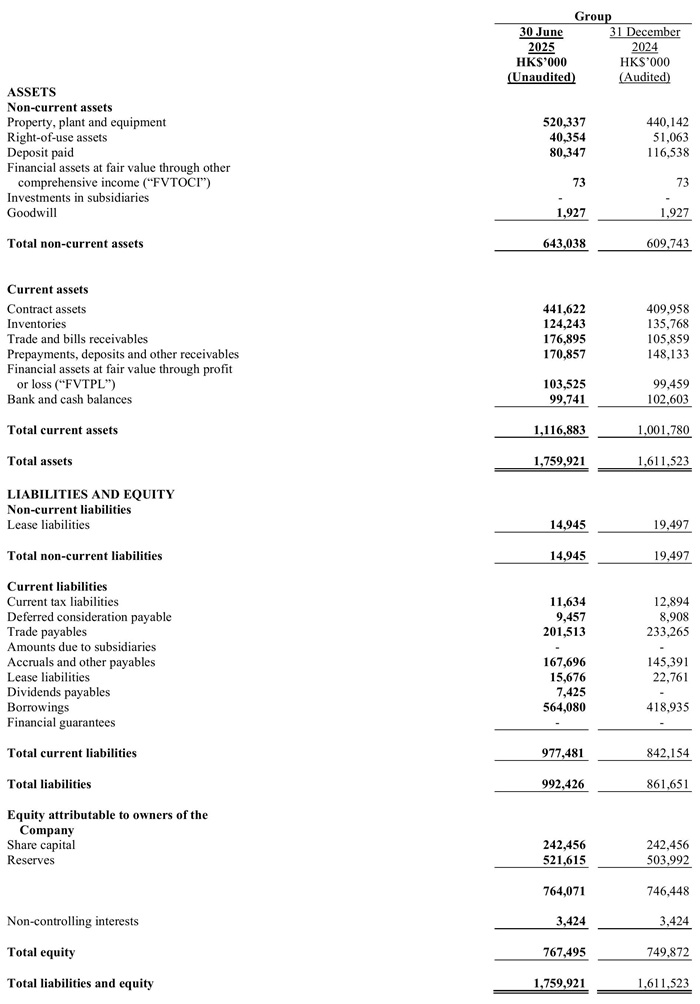

CONDENSED STATEMENTS OF FINANCIAL POSITION AT 30 JUNE 2025

Review of Performance

Profit and Loss

Revenue

The Group’s overall revenue increased by HK$211.1 million or 31.8%, from HK$664.5 million in HY 2024 to HK$875.6 million in HY 2025. The increase was mainly attributed to our key customers’ increasing demand for diverse range and high quality toy products.

Gross profit and gross profit margin

With the increased sales in HY 2025, the Group’s gross profit increased by 17.9% or HK$13.4 million, generating a gross profit margin of 10.1% (HY 2024: 11.3%). The gross margin percentage decreased by 1.2%, mainly because of the Group’s increased use of more costly eco-friendly raw materials, in response to customer’s request for sustainable products.

Other Income

The Group’s other income increased by HK$4.0 million or 37.7%, from HK$10.6 million in HY 2024 to HK$14.6 million in HY 2025. This was primarily attributed to the interest and fair value change generated from financial investment, which was recognized as FVTPL.

Selling and distribution expenses

The Group’s selling and distribution expenses increased by HK$2.7 million or 31.8%, from HK$8.5 million in HY 2024 to HK$11.2 million in HY 2025. The increase was largely in line with the growth in revenue, which in turn led to a rise in related freight costs and export handling fees.

Administrative expenses

The Group’s administrative expenses increased by HK$18.3 million or 49.5%, from HK$37.0 million in HY 2024 to HK$55.3 million in HY 2025. The increase is mainly due to the expansion of production scale in Indonesia, which has led to rises in related management personnel salaries, operating expenses of new subsidiaries, travel expenses as well as ongoing investments in operational enhancement initiatives and the initial costs associated with the expansion of new production programs.

Finance Costs

Finance costs increased by HK$0.7 million or 4.7%, from HK$14.8 million in HY 2024 to HK$15.5 million in HY 2025. Although the borrowing scale has increased, the interest on borrowings has not risen significantly, largely due to the decline in Hibor and the preferential terms negotiated with banks.

Income Tax Expenses

Income tax expenses increased HK$1.1 million or 28.2%, from tax expenses of HK$3.9 million in HY 2024 to HK$5.0 million in HY 2025. The increase can be attributed primarily to the increased revenue and assessable profit distribution among countries and area.

Balance Sheet

Non-current assets

The Group’s non-current assets stood at HK$643.0 million as at 30 June 2025, increased by 5.5% or HK$33.3 million, from HK$609.7 million at 31 December 2024. This was due to:

- an increase of HK$114.1 million in property, plant and equipment for acquisition;

- an increase of HK$21.9 in deposit paid for Indonesia new factory construction; and

- an increase in differences on translating foreign operations of HK$10.3 million;

which were partially offset by:

- a decrease of HK$58.1 million in deposit paid balance for the transfer to property, plant and equipment; and

- a depreciation for property, plant and equipment and right-of-use assets of HK$54.9 million.

Current assets

The Group’s current assets stood at HK$1,116.9 million as at 30 June 2025, an increase of HK$115.1 million or 11.5%, from HK$1,001.8 million as at 31 December 2024, mainly due to:

- an increase in contract assets of HK$31.7 million;

- an increase in trade and bills receivables of HK$71.0 million to HK$176.9 million as at 30 June 2025. Approximately HK$131 million of these trade receivables have been subsequently settled or replaced as at the date of this announcement;

- an increase in prepayments, deposits and other receivables of HK$22.7 million; and

- an increase in financial assets at FVTPL of HK$4.1 million;

which were partially offset by:

- a decrease in inventories of HK$11.5 million; and

- a decrease in bank and cash balances of HK$2.9 million.

Current liabilities

The Group’s current liabilities stood at HK$977.5 million at 30 June 2025, increased by HK$135.3 million or 16.1%, from HK$842.2 million at 31 December 2024, mainly due to:

- an increase in short-term borrowings of HK$145.2 million to finance working capital requirements;

- an increase in accruals and other payables of HK$22.3 million;

- an increase in dividends payables of HK$7.4 million; and

- an increase in deferred consideration payable of HK$0.6 million;

which were partially offset by:

- a decrease in trade payables of HK$31.8 million;

- a decrease in lease liabilities payables of HK$7.1 million; and

- a decrease in current tax liabilities of HK$1.3 million

Non-current liabilities

The Group’s non-current liabilities stood at HK14.9 million as at 30 June 2025, a decrease of HK$4.6 million or 23.6%, from HK$19.5 million as at 31 December 2024 mainly due to decreases in finance lease payables of HK$4.6 million.

Cash Flow Analysis

The Group’s cash resources of HK$99.7 million as at 30 June 2025 are considered adequate for current operational needs. The net decrease in cash and cash equivalents of HK$4.4 million held by the Group comprised:

- Net cash used in operating activities of HK$73.3 million to finance working capital needs;

- Net cash used in investing activities of HK$61.1 million mainly due to additions of property, plant and equipment and deposit paid for leasehold lands in Indonesia; and

- Net cash generated from financing activities of HK$130.0 million, mainly due to the increasing loans.

Commentary

Looking ahead, we are well positioned to capture growth opportunities in the evolving toy and premium goods market. Our strategic execution is supported by disciplined capital management and diversification of customers and capabilities, and provides a strong foundation to navigate macroeconomic uncertainties and deliver sustainable long-term value to our stakeholders.

As we progressed through 2H 2025, the global operating environment remains challenging, shaped by elevated interest rates, persistent inflationary pressures, and evolving trade dynamics, including ongoing tariff realignments. These factors are reshaping global supply chains and prompting manufacturers in the toy and premium goods industries to reassess and optimize their production footprints to balance cost efficiency and enhanced market access. While such conditions pose near-term headwinds, they also present meaningful opportunities for agile, forward-looking companies to reposition strategically for the longer term.

In this context, the Group has taken decisive steps to reinforce our long-term competitive positioning. Our strategic diversification into Indonesia enables us to benefit from favorable tariff structures and a cost-efficient manufacturing base while bolstering supply chain resilience. This expansion is complemented by our intensified focus on green manufacturing practices, with eco-friendly materials now contributing 71% of 1H 2025 revenue, reflecting both strong customer alignment and our industry leadership in sustainability.

To support growth, we are investing significantly in quality management systems, IT infrastructure, and automation to drive operational excellence and production stability. The commencement of Plush Phase 2 in Indonesia in 1H 2025 has substantially increased capacity, with annual plush output expected to double year-on-year. The construction of our die-casting facility remains on track for launch in Q4 2025.

Our workforce has grown to approximately 20,000 employees across Indonesia, Mainland China, Hong Kong and Singapore, enabling us to scale our production needs while deepening our technical and management depth. At the same time, we have secured new strategic customers, formalizing partnerships that will broaden our revenue base and improve earnings visibility.

These strategic initiatives are underpinned by our broader commitment to sustainability and operational efficiency, including the adoption of solar energy and bio-based materials across our facilities. Our ESG leadership has been further validated through accolades such as the "2025 ESG Exemplary Enterprise Award" and "2025 ESG Outstanding Listed Company Award" awarded at the 4th International Green Zero Carbon Festival, reinforcing our reputation as a trusted, forward-looking partner to global brands.

In the next 12 months, our priorities include enhancing supply chain resilience and expanding our production capacity, particularly by leveraging on the diversification of our manufacturing base in Indonesia to meet demand with greater efficiency while mitigating risks associated with geopolitical tensions and economic fluctuations.

With continued innovation, operational discipline, and an unwavering commitment to sustainability, the Group remains confident in our ability to drive resilient growth and create long-term value in an increasingly dynamic global landscape.